With 12 years of life and born in the midst of the financial sector crisis EVO continues to be a one hundred percent digital bank. The company has managed to maintain this essence despite being acquired in 2019 by Bankinter.

Its 'technological DNA' is what has led the entity to conduct some experiments with generative artificial intelligence, as well as machine learning. In the framework of the DES (Digital Enterprise Show) in Malaga the firm explained how it has integrated them together with its technological partner.

"As a neobank we were losing 40 million euros a year, but after being bought last year we reached break even and we are looking to continue growing thanks to technology," stressed Paz Comesaña, director of Marketing, Advertising, CRM and Strategic Alliances at EVO Banco.

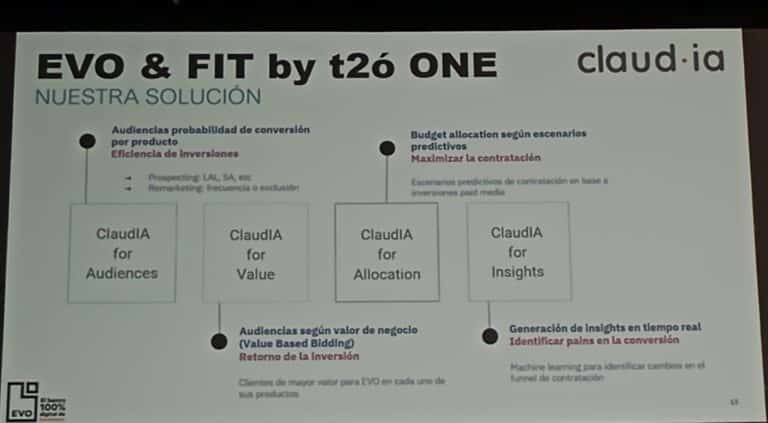

EVO Banco has relied on FIT, t2ó ONE's technology consultancy, and ClaudIA, its digital marketing technology platform. It is supported by Google Cloud Platform technology and combines AI with Big Data and machine learning.

Thanks to it, the financial company has been able to optimize its investment in digital media by creating intelligent audiences. ClaudIA has allowed the digital bank to carry out predictive scoring to know whether its visitors were going to convert or not.

According to Comesaña, EVO faced three challenges: contracting smart accounts or mortgages, reducing the cost of acquisition and anticipating a cookieless environment.

Three phases

Álvaro Sánchez, CIO of t2ó, commented on how they follow three phases for ClaudIA. In the first they insert a pixel of their technology on the web and collect data from various sources for several weeks before moving on to the next stage.

The second step is data analysis and transformation. Here they do a correlation and mutual information analysis to find the structure.

In the third stage, more than 80 different algorithms come into play. Here they create the models and analyze the first predictions. From all of them, they have found the three algorithms that work best for the EVO data.

"We have been training and using many models. These are going to vary according to seasonality and competition," the expert explained.

Copies already used to generate new copies

The company also told how they plan to continue growing in the field of generative AI.

In the case of EVO Banco, they are helping the bank to generate content that 'converts' better on its website and other platforms. Thus, they are using the texts, images and videos that the bank already had to create new ones. In the case of the 'copies', they have been based on those that the firm already had to generate new ones that are more effective in attracting and retaining customers.