Technology thrives on innovation, and today, the sector is in a period of renewal and reinvention. Tech is healthy, vibrant, and moving forward assertively, driven by strong global demand and broad interest in new technologies.

Post-Covid reset

What looked like a slowdown was actually a reset. After the Covid-19 spending bubble, demand slowed, valuations fell, and profitability mattered again. The sector responded by cutting costs and laying off thousands, then quickly bounced back with market caps near peak levels again.

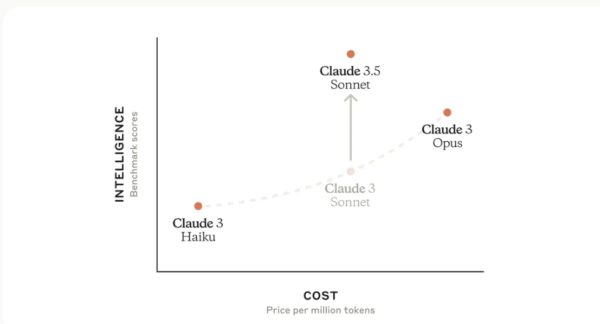

This rebound rides on optimism. Technology is increasingly central to everything we do—personally, professionally, and as a society. Even during periods of economic uncertainty, companies continue to invest in technology. Large language models and generative AI represent the most significant disruption since the Internet. The need for resilience in supply chains is creating capacity in new places. These are the investments that will propel and reshape the tech sector in the years ahead.

Value evolution

The technology sector has seen substantial evolution in value creation strategies. Investors are attracted to young, disruptive companies based on their growth potential. As companies and their markets mature, investors expect a mix of growth and returns. Mature companies with a proven track record in stable markets can expect slower growth while their investors are closely focused on profitability and return on invested capital. Understanding where a company is in its life cycle and signaling expectations to the right group of investors is essential for attracting the capital needed to operate.

Post-globalization Era

Tech companies are diversifying their supply chains, R&D locations, and talent pools to build resilience against global shocks. The semiconductor industry, for example, is responding to government incentives to make large, long-term investments in fabs in the US, Japan, and Germany. These changes will create new technology hubs and shift the competitive landscape—partly as a result, the hiring of engineers is accelerating in India and Europe. A decade from now, the global footprint of the technology value chain is likely to look very different, but companies should be evaluating their options today.

Operational transformations

Companies with modern technology architectures outperform their competitors with better customer service, more efficient operations, and stronger customer advocacy. Modern architectures are Agile, real-time, and intelligent, personalizing experiences using artificial intelligence and machine learning. Only 13% of executives say they are getting the business value they expected from their spending on technology. Developing a better understanding of the connection between architecture and business value can help companies get a better return on those investments.

But Generative AI has also become a double-edged sword in cybersecurity. On one hand, it strengthens defenses; on the other, it empowers cyberattackers. Less experienced attackers can use it to create more enticing emails or realistic deepfake videos. Generative AI allows bad actors to easily rewrite known attack codes to avoid detection. The threat from bad actors will only increase as they use generative AI to standardize and update their tactics, techniques, and procedures. Agile cybersecurity operations will be necessary to stay ahead.

Future trends

The technology sector is poised for continued innovation and transformation. Companies must navigate the evolving landscape by investing strategically, managing risks, and embracing new technologies. The era of post-globalization, operational transformations, and the rise of generative AI will redefine how technology creates value and drives progress. The next decade will be crucial for companies to establish their positions and capitalize on emerging opportunities in this dynamic sector.